Navigating The Double Materiality Landscape: Challenges And Opportunities

Have you ever experienced the feeling that businesses seem to be speaking a language you cannot understand? You hear about sustainability and ESG, and other times you come across the term "double materiality". It sounds like some boardroom buzzword.

Source: Image

This blog will help to break it for you, just in a slightly different way

Reimagining the Concept of Double Materiality

Recently, I happened to read a very thought-provoking and interesting piece written by Viveck J Suman, titled “Embracing Double Materiality for a Sustainable Future”. The article was a real eye-opener and I was eager to chip in with my reflections, or maybe a whole dollar’s worth to the conversation.

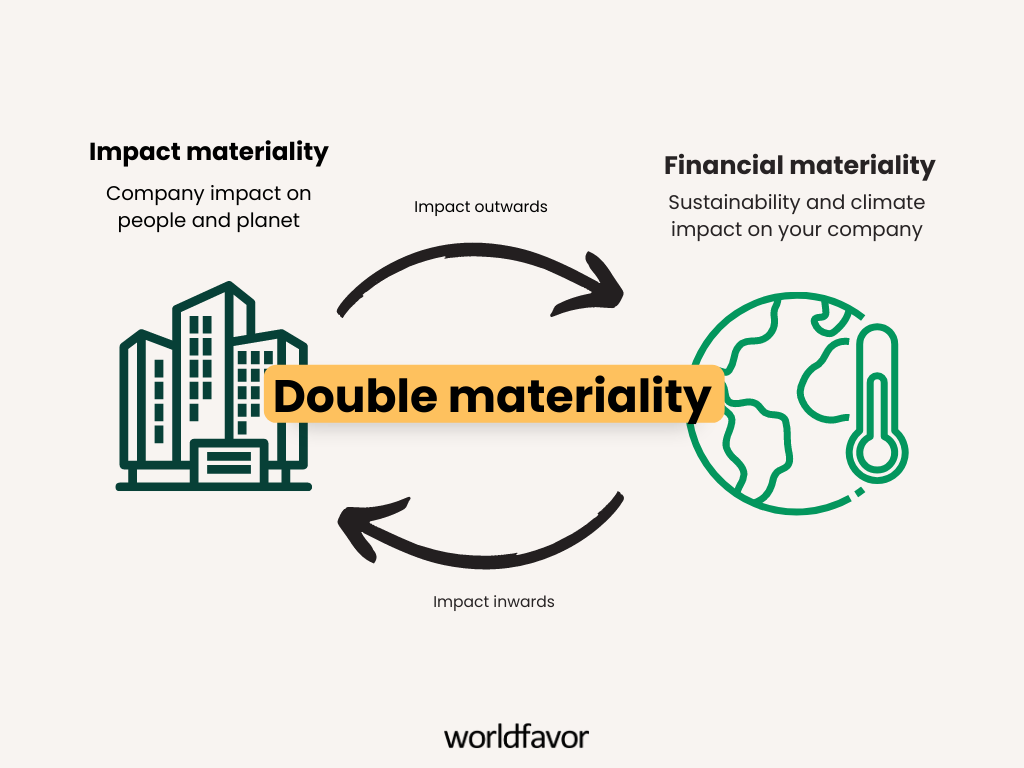

Viveck got it right from the get-go: It is about acknowledging the two-way relationship—how environmental factors influence a company’s financial health and how, in turn, a company’s actions impact the environment and society. Simple, right?

In the upcoming sections, this blog aims to expand on these points and offer a critical perspective on the practical implementation of double materiality.

Key Insights : Linked blog pointed out the double materiality framework that companies need to adopt in the current era of a dynamic environment. In the past, people have always been reminded of the direct responsibilities that companies owe financially to the wider community and their respective shared environmental and social effects.

As said in blog “risks and evolving stakeholder expectations, this dual approach is no longer optional—it is essential for long-term corporate resilience."

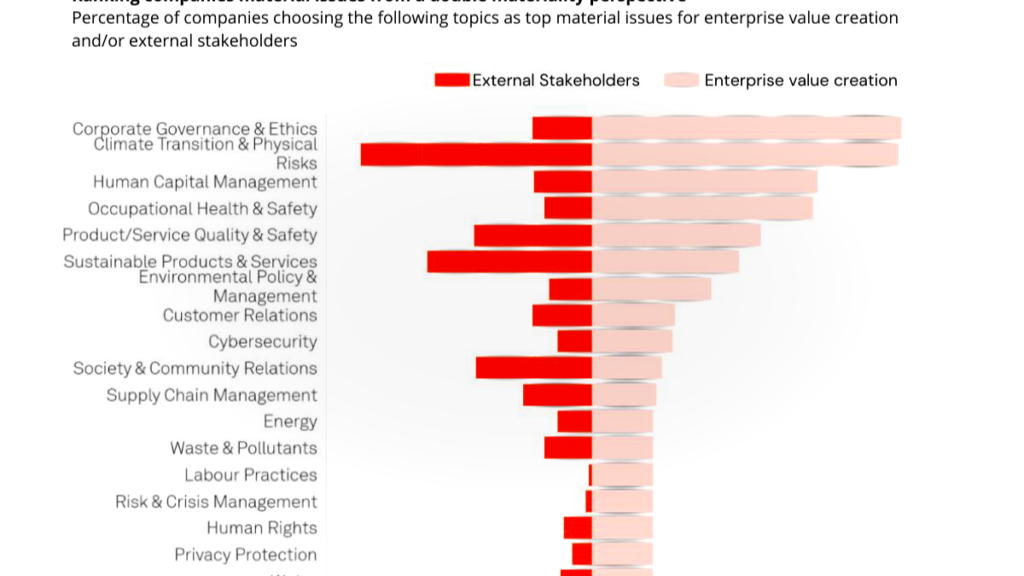

Additionally, the quoted blog rightly cites the S&P Global Corporate Sustainability Assessment 2024, which reveals that while many companies identify material risks for enterprise value (4,592), less than half (1,902) report on stakeholder impacts. This data highlights the existing gap and underlines the urgency for businesses to evolve. That’s less than half! It's as if one said, “Sure, my house is important to me, but does the neighborhood matter?

Source: Image

Balancing Enterprise Value and Stakeholder Concerns

This made me reflect on something. We often get to listen to how “enterprise value” is the king. And true tooh. You need to keep the lights on and pay your employees.

But here's the thing: focusing solely on the bottom line is like building a sandcastle at high tide. It looks good for a minute, but… wait for what happens next?

While Viveck rightly prioritizes enterprise value in identifying key material issues, it is equally important to recognize that sustainable growth depends on a broader stakeholder lens, including community relationships, environmental management, and sustainable product offerings.

It's time to be real now. You might be aware of the fact that according to a World Economic Forum Report, climate risks could expose the whole global financial system to a loss of about $43 trillion up to the end of the century? It’s not a typo .Yes , you read it right, Trillions! And it’s not just a kind of abstract future because we are talking about the consequences of record-breaking weather conditions, supply chain breaches, and lack of resources. These are the disruptions that are hitting businesses now.

Source: Image

And it's not just about the big picture. Look at the local level. A company polluting a nearby river might save a few bucks on waste disposal, but what about the community that relies on that river for drinking water and fishing? What about the long-term health costs and the loss of local businesses? Those costs don’t just vanish; they get passed on, often to the most vulnerable.

According to a 2023 Edelman Trust Barometer report, 64% of consumers make buying decisions based on a brand’s beliefs and values. If you're not playing the sustainability game, you’re losing customers. For businesses looking to enhance their brand image and align with sustainable values, exploring a brand-building consultancy can be a strategic move.

One has to appreciate that there’s a significant overlap, especially in climate-related risks, that affect both financial performance and societal impact. Ignoring them may lead to short-sighted gains but long-term vulnerabilities.

Practical Implications and the Way Forward

Okay, so we've talked about the problems, the disconnect between what companies say and what they do. But the good news is that we can fix this. And honestly, it’s not rocket science. It's about shifting our mindset.

Instead of thinking of sustainability as some add-on, something you do to tick a box, we need to weave it into the very fabric of our businesses. It’s like baking a cake – you can’t just sprinkle the ingredients on top and hope it turns out right. You gotta mix them in from the start.

- Stakeholder Integration: Stop lecturing stakeholders but rather communicate with them. Community meetings, surveys, even social media listening – find out what matters to them.

- Transparent Reporting: You need to avoid greenwashing. Instead, publish real, provable data on your environmental and social impacts. Use frameworks like the Global Reporting Initiative (GRI) or the Sustainability Accounting Standards Board (SASB).

- Circular Economy: Implement the model of "reduce, reuse, recycle." Instead, focus on finding new techniques and strategies for waste reduction and energy utilization.

- Long-Term Investment: Use some part of the sum for investing in sustainable technologies and practices. Yes, it is unquestionably a larger sum of money at the outset, but the return of investment in long-term resilience and competitive advantage is worthwhile.

- Employee Engagement: In fact, your staff is the best spokesperson for your brand. They should be enabled to be part of the solution. Create a real sustainability action plan, get your team trained on the best practices, and make sure to highlight and celebrate everyone's contributions.

If double materiality feels overwhelming, exploring business consultancy—particularly with local expertise in India—can offer clarity. For tourism businesses, imagine the impact a sustainable travel and tourism consultancy can have in future

Conclusion

Look, we can't keep treating double materiality like a chore. It's not just about ticking boxes; it's about building a future where business matters. Viveck’s blog got us started, but we need to go further. Like I said before, real sustainability strategies? They need this. There's help out there if you need it. Bottom line? The future's here, and it's asking: Are we building businesses that mean something? Let's do that First

FAQs

What exactly is "double materiality"?

Double Materiality looks at sustainability from two angles: how environmental and social factors impact a company's financial health, and how the company's actions affect the environment and society.

Why should my business care about double materiality?

It's about building long-term resilience, meeting investor expectations, and staying relevant to consumers who increasingly care about sustainability.

How can I start implementing double materiality in my company?

Start by listening to your stakeholders – customers, employees, and community. Be transparent about your impacts. Look for ways to reduce waste and embrace the circular economy.